Percentage of taxes taken out

If youd like to calculate the overall percentage of tax deducted from your paycheck first add up the dollar. Youll pay 62 and 145 of your income for these taxes respectively.

Sales Tax Is Called A Regressive Tax Because People Who Make Less Money End Up Spending A Larger Portion Of Their Pay Infographic Math Review Finance Investing

Alabama has income taxes that range from 2 up to 5 slightly below the national average.

. Pennsylvania levies a flat state income tax rate of 307. Social Security tax 124. Pennsylvania is one of just.

Every taxpayer in North Carolina will pay 525 of their taxable income for state taxes. Ad Compare Your 2022 Tax Bracket vs. FICA Federal Insurance Contributions Act taxes are Social Security and Medicare taxes.

The next chunk up to 41775 x 12 12. North Carolina has not always had a flat income tax rate though. Discover Helpful Information And Resources On Taxes From AARP.

The federal government requires that you pay 62 percent of your gross pay for FICA taxes and one-half of your Medicare taxes. There are four tax brackets starting at 3078 on taxable income up to 12000. You and your employer will each contribute 62 of your earnings for Social Security taxes and 145 of your earnings for Medicare taxes.

Current FICA tax rates The current tax rate for social security is 62 for the employer and 62 for the employee or. Individuals who make up to 38700 fall in the 12 percent tax. Also Know how much in taxes is taken out of my paycheck.

The federal income tax rate is between 20 to 30 for most income ranges so if you set aside about a quarter youll be fairly prepared. What is the percentage that is taken out of a paycheck. Like the states tax system NYCs local tax rates are progressive and based on income level and filing status.

Break the taxable income into tax brackets the first 10275 x 1 10. Your 2021 Tax Bracket To See Whats Been Adjusted. Given that the second tax bracket is 12 once we have taken the.

This comes to 102750. These taxes together are called FICA taxes. 62 of each of your paychecks is withheld for Social Security taxes and your employer contributes a.

How do I calculate the percentage of taxes taken out of my paycheck. Federal income tax and FICA tax. Cant speak for state and local income taxes though.

The employer portion is 15 percent and the. Therefore your income level and filing status will not affect the income tax rate you pay at the state level. The result is that the FICA taxes you pay are still only 62 for Social Security and 145 for Medicare.

Overview of Alabama Taxes. Given that the first tax bracket is 10 you will pay 10 tax on 10275 of your income. This is divided up so that both employer and employee pay 62 each.

How Your Paycheck Works. Divide this number by the gross pay to determine the percentage of taxes taken out of a paycheck. The Heart of Dixie has a progressive income tax rate in which the.

Calculate Take-Home Pay If the. And the remaining 15000 x 22 22 to produce taxes per. How much tax do they take out of 500.

FICA contributions are shared between the employee and the employer. In 2013 the North Carolina Tax. 62 of each of your paychecks is withheld for Social Security taxes and your employer contributes a further 62.

The other federal taxes do have standard amounts they are as follows. Your Federal Income Tax You would be taxed 10 percent or 900 which averages out to 1731 out of each weekly paycheck.

Government Revenue Taxes Are The Price We Pay For Government

Great Percentage And Personal Finance Enrichment Project Students Learn About Paying Taxes And Calcu Real Life Math Fun Math Projects Math Enrichment Projects

Returns Filed Taxes Collected And Refunds Issued Internal Revenue Service

Tax Evasion Among The Rich More Widespread Than Previously Thought The Washington Post

Sales Tax Anchor Chart Math Anchor Charts Anchor Charts Middle School Math

Don T Wait Till Its Time To File Your Tax Return The Key To Lowering Your Federal Tax Liability Is To Take Action Now For More T Tax Brackets Tax Return Tax

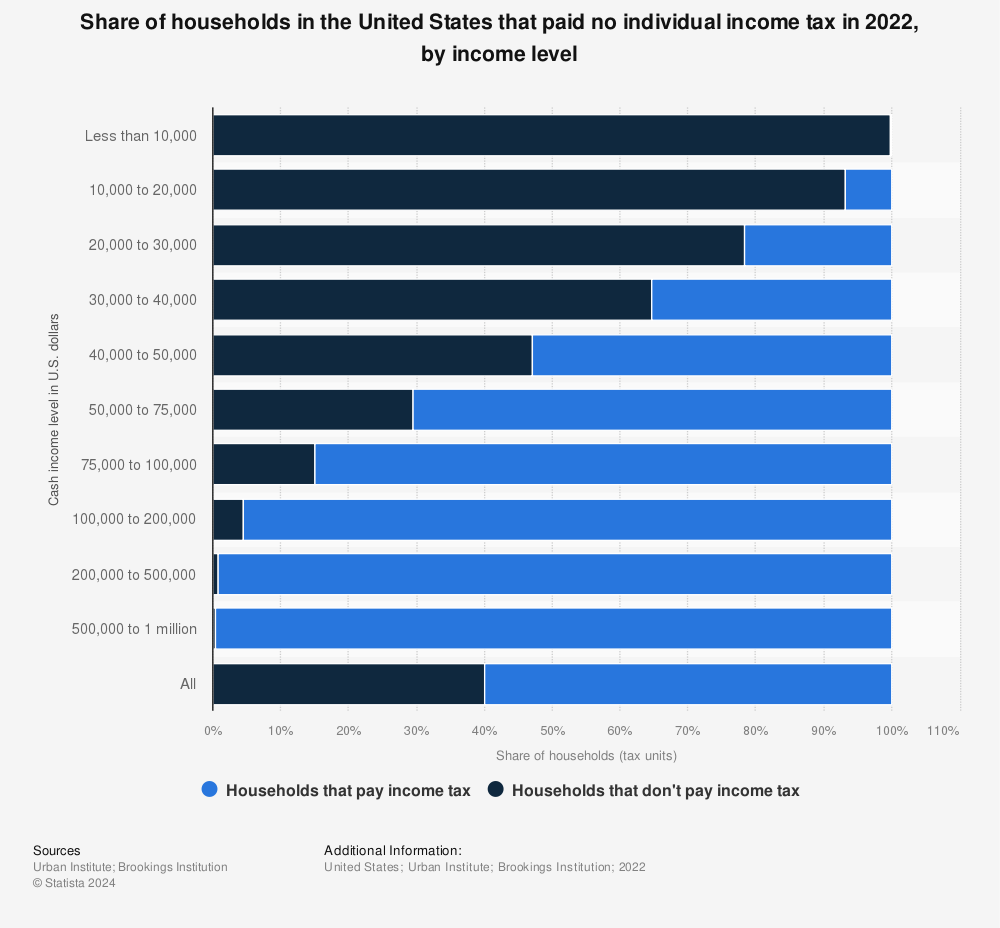

Percentages Of U S Households That Paid No Income Tax By Income Level 2021 Statista

Pin On Sociology Visuals Economy

Policy Basics Federal Payroll Taxes Center On Budget And Policy Priorities

Tax Deductions For A Home Office Infographic Home Office Home Office Decor Home Office Organization

This Is What You Need To Know The First Year You File Business Taxes

Income Tax Task Cards Activity Financial Literacy Filing Taxes Math For Kids

New Data Offer First Infuriating Glimpse At How The Richest 0 0001 Pay Taxes Income Tax Income Paying Taxes

Pin On Houston Real Estate By Jairo Rodriguez

1040 Income Tax Cheat Sheet For Kids Consumer Math Consumer Math High School Financial Literacy Lessons

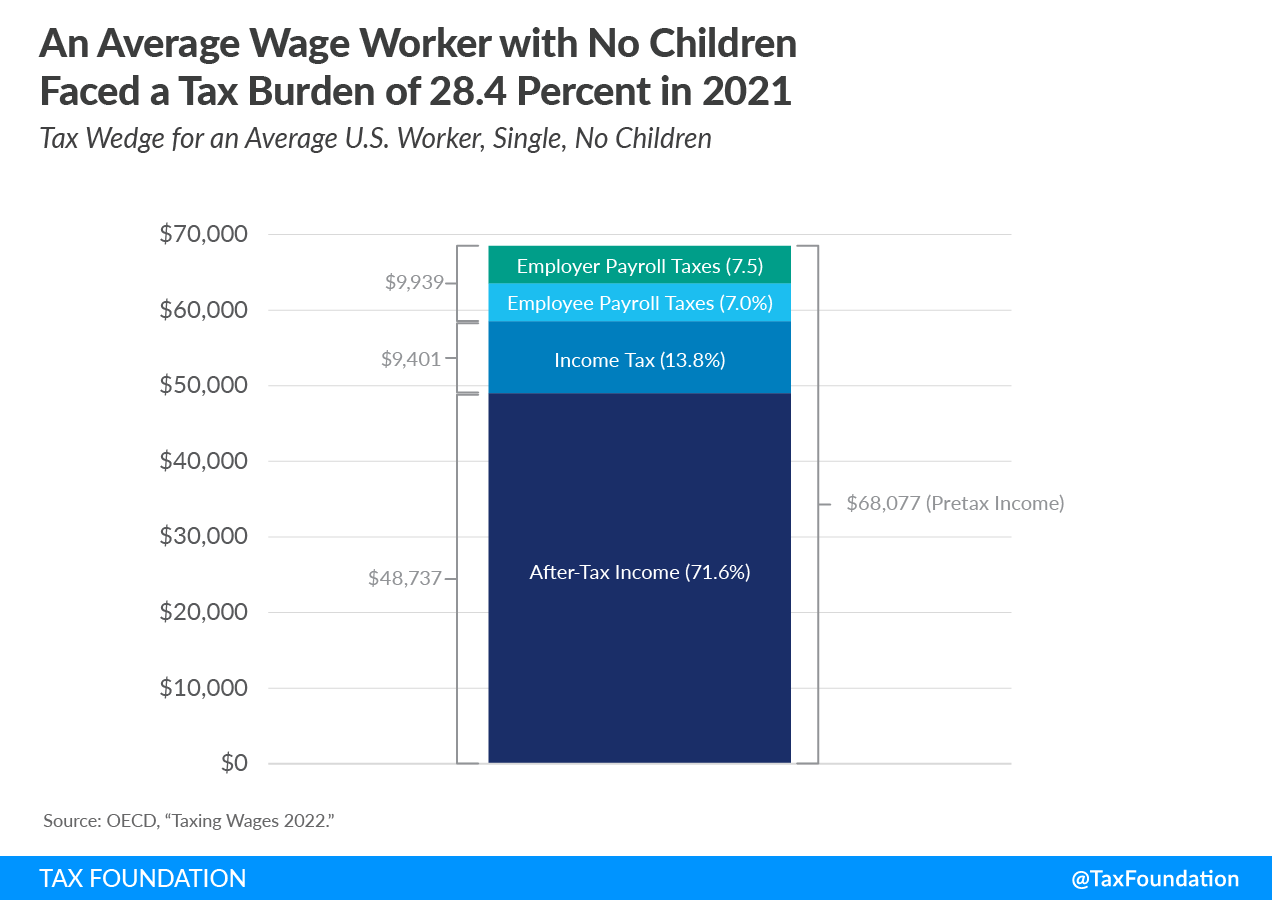

Tax Wedge Taxing Wages Details Analysis Tax Foundation

2021 2022 Federal Income Tax Brackets Tax Rates Nerdwallet